capital gains tax proposal effective date

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. The House Ways and Means Committee released their tax proposal on September 13 2021.

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

That includes a 20 capital-gains tax on.

. 13 2021 under the proposal so investors would not have time to adjust their portfolios before the law goes into. Capital Gains Tax Rate Set at 25 in House Democrats Plan Rate would rise from 20 under House panels proposal Biden had wanted to boost rate to 396 for highest earners. Under the proposal 37 would generally be the highest individual tax rate or 408 including the net investment income tax but only if the taxpayers income exceeded 1 million.

Under each of these scenarios taxpayers could. Bidens Capital Gains Proposal. Dems eye pre-emptive capital gains effective date.

The new rate would apply to gains realized after Sep. The green book indicated the capital gain hike would be effective for gains required to be recognized after the date of announcement secretary yellen. Democrats make the change effective back to April or May though this seems very unlikely.

President Joe Bidens proposed budget for the upcoming fiscal year assumes that a hike in the capital-gains tax rate took effect in late April meaning that it already would be too. Understanding Capital Gains and the Biden Tax Plan. A taxpayer with 900000 in labor income and 200000 in capital gains would have 100000 of capital gains taxed at the current preferential tax rate and 100000 taxed at.

This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28. The bill falls apart and there is no capital gains rate increase at all success on the bill is far from guaranteed. It would apply to those with more than 1 million in annual income.

Capital Gains Tax Proposal Effective Date. Planning For A Potential Capital Gains Hike All of this is to say that the most likely outcome by far is that if any changes to the top capital gains rate are made which still seems. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

A summary can be found here and the full text here. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the. This proposal would be effective for gains required to be recognized after the date of announcement according to Treasury Department materials released Friday afternoon.

Capital gains tax increase effective date. Importantly the increase in rates would be effective as of Sept. The proposal would be effective for gains recognized after the undefined date of announcement which could be interpreted as the April 28 2021 date of the release of the.

KPMG Catching Up on Capitol Hill Podcast Episode 13-2021 Its not just the how much the capital gains tax rate may increase its the when. In 2022 it would kick in for single filers with taxable income over 400000 and for married couples at 450000 according. The White House plan would instead tax capital gains as ordinary income at a top proposed rate of 396.

Democrats compromise on a prospective effective date of Jan. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. 1 2022 or later this is certainly possible.

Capital gains tax proposal effective date Tuesday April 12 2022 In his budget plan released May 28 Biden proposed making the capital gains tax changes retroactive to April. Taxpayers can also consider other rate arbitrage opportunities as democrats are largely proposing effective dates of jan. No effective date for the change in capital gain tax rates for individuals was mentioned on the campaign trail or in President Bidens American Families Plan speech or fact sheet but the.

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Tax Measures Supplementary Information Budget 2022

Biden S Better Plan To Tax The Rich Wsj

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

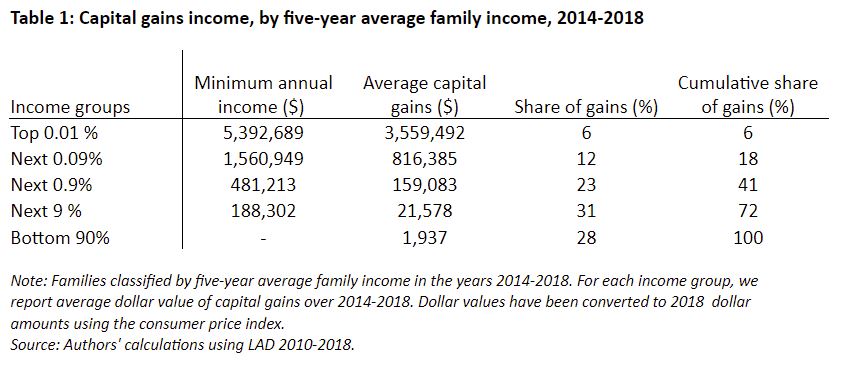

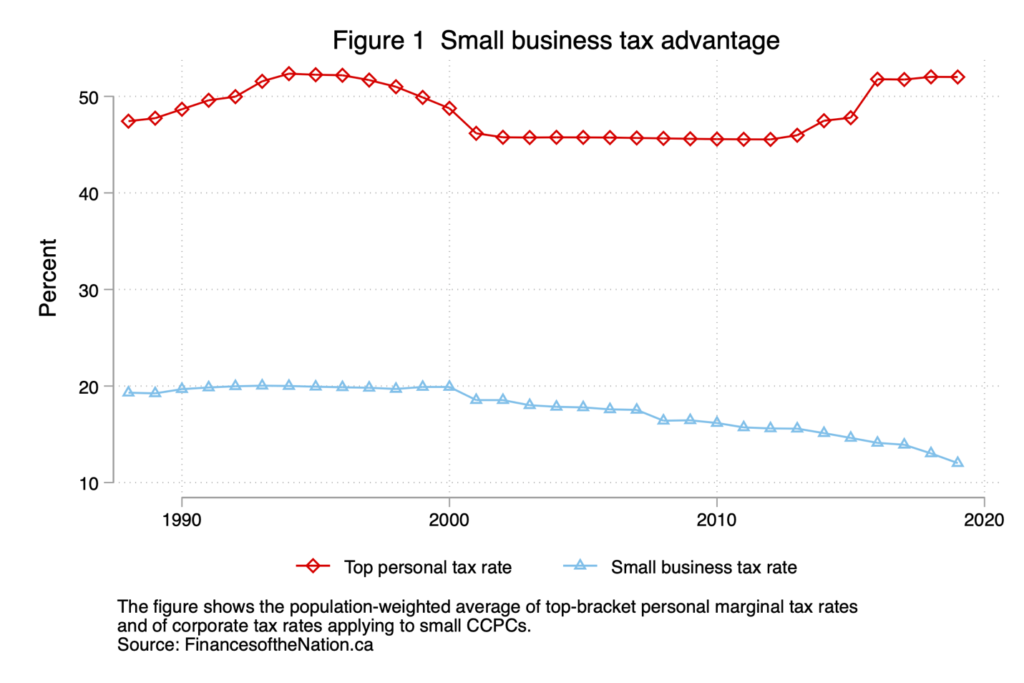

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

Capital Gains Implications Of Gifts Other Transactions

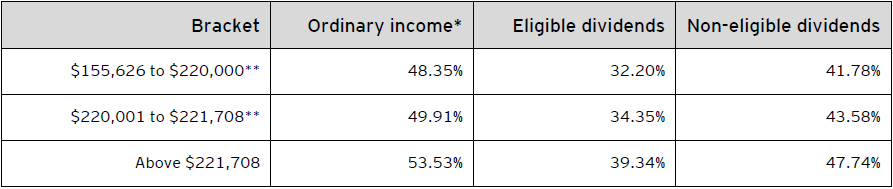

Ey Tax Alert 2022 No 27 Ontario Budget 2022 23 Ey Canada

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

Archived Tax Planning Using Private Corporations Canada Ca

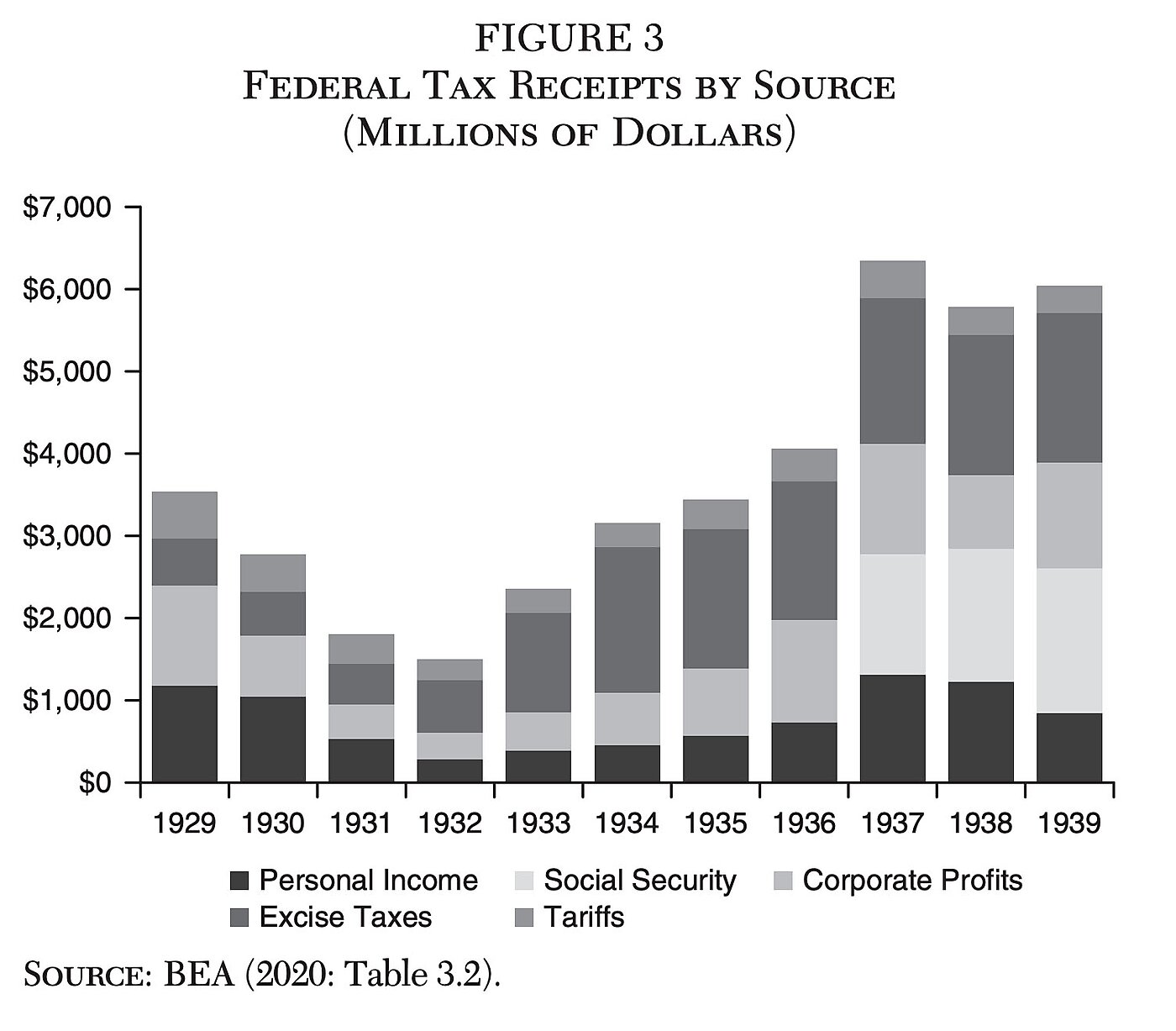

The Economic Impact Of Tax Changes 1920 1939 Cato Institute

Timesheet With Expenses Printable Time Sheet Expenses Printable Carpet Cleaning Hacks Natural Carpet Cleaning

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

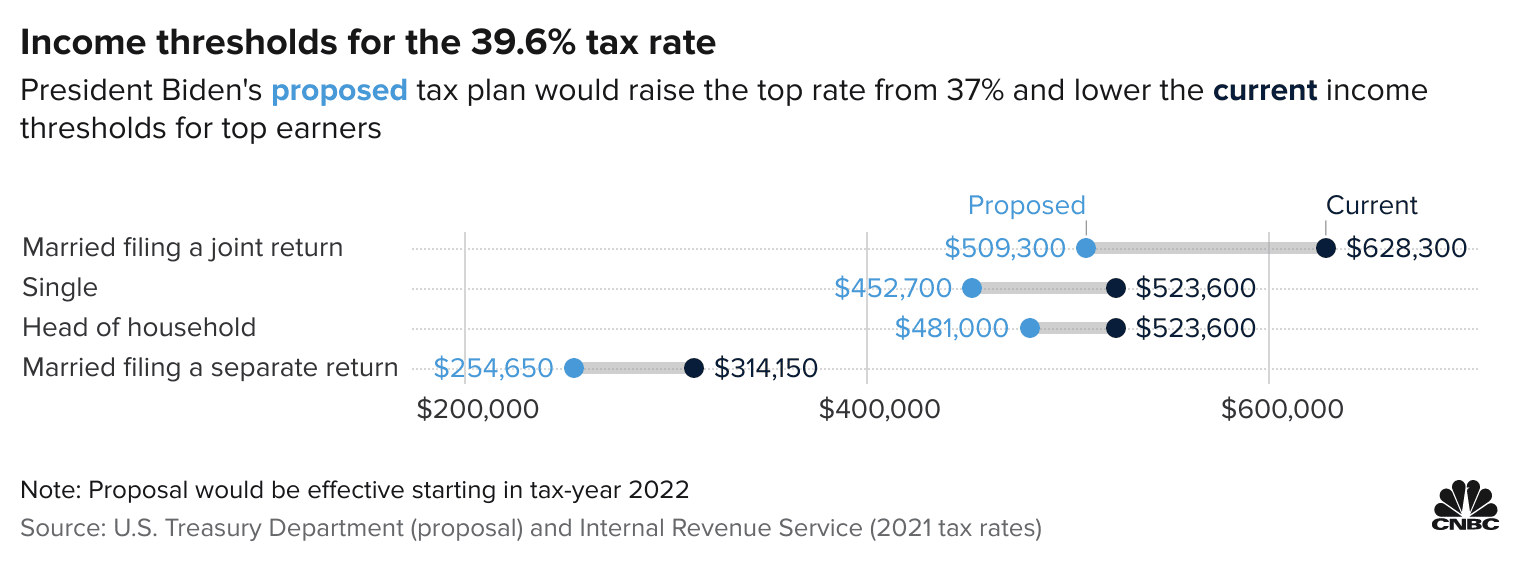

Biden S Proposed 39 6 Top Tax Rate Would Apply At These Income Levels

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada